The COVID-19 pandemic left an indelible mark on the global labor market, triggering unprecedented job losses and a surge in unemployment rates. As economies gradually recovered, new trends and challenges emerged, reshaping the employment landscape. This article explores the dramatic employment shifts from 2020 to 2024, the factors influencing recovery, and what lies ahead for the workforce in a rapidly changing world.

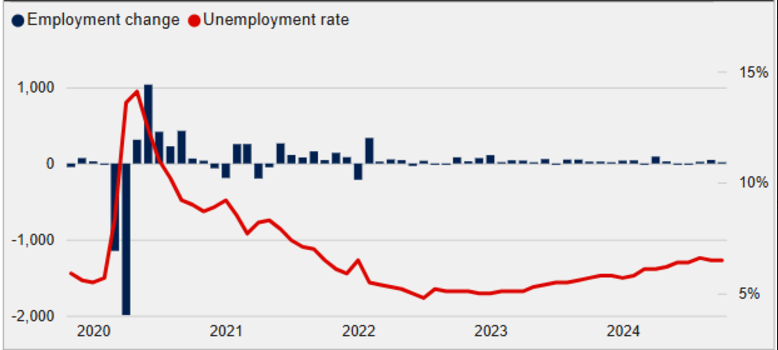

The graph above illustrates the evolution of Canada’s employment and unemployment dynamics from 2020 to 2025. It highlights how the Canadian labor market was impacted by the COVID-19 pandemic, the subsequent recovery, and the stabilization phase. Here’s an analytical breakdown of the trends reflected in the graph.

The onset of the COVID-19 pandemic in early 2020 created unprecedented challenges for Canada’s labor market:

Employment Plunge: The blue bars show a sharp decline in employment, with monthly job losses reaching nearly 2 million at the height of the pandemic. This was primarily driven by lockdowns, business closures, and widespread uncertainty.

Unemployment Rate Spike: The red line indicates a steep rise in the unemployment rate, which surged to over 15%—a historic high for Canada. Entire sectors such as retail, hospitality, and travel were devastated, leaving millions of Canadians jobless.

This period represents the most significant labor market disruption in decades, reflecting the broader economic shock brought on by the global health crisis.

As Canada adapted to the pandemic through vaccination rollouts and easing restrictions, the labor market began to recover:

Consistent Job Gains: Monthly employment changes turned positive in mid-2020, as businesses reopened and rehired workers. The blue bars in the graph show steady job recovery during this period, though some months exhibited slower growth.

Declining Unemployment: From its peak in 2020, the unemployment rate dropped sharply, reflecting increased workforce participation and demand for labor. By late 2021, unemployment fell closer to single digits.

While this period marked a strong rebound, the recovery was uneven across industries. Sectors like technology and healthcare expanded rapidly, while hospitality and retail faced slower recoveries.

The graph shows a transition to a more stable labor market from 2022 onward:

Reduced Employment Volatility: Monthly employment changes fluctuated around zero during this period, suggesting fewer significant job gains or losses. This indicates that the initial surge of post-pandemic recovery had tapered off.

Unemployment Rate Stabilization: By 2023, the unemployment rate stabilized, but a slight increase in 2024 suggests potential structural changes in the labor market. Factors such as sectoral shifts, automation, and demographic changes likely contributed to this trend.

The slight uptick in unemployment in 2024 may also be attributed to cautious business hiring amidst rising interest rates and inflationary pressures.

Looking ahead, several factors will shape Canada’s labor market:

Unemployment Rate Stabilization: The unemployment rate is projected to stabilize around 5% to 6%, aligning with pre-pandemic norms for developed economies. As of June 2024, Canada's unemployment rate stood at 6.4%, slightly above the pre-pandemic rate of 5.6%.

Industry Growth: Sectors such as technology, healthcare, and green energy are expected to drive job creation. For instance, the environmental sector workforce increased by approximately 5% in 2020, indicating resilience and potential for future growth

Central bank interest rate hikes to curb inflation could constrain business investments, limiting aggressive job growth.

Rising borrowing costs may lead to cautious hiring, especially in sectors sensitive to consumer demand.

Immigration Levels Adjustment: The federal government has announced a reduction in immigration levels, with targets set at 395,000 new permanent residents in 2025, 380,000 in 2026, and 365,000 in 2027, down from 485,000 in 2024

Labor Market Impact: These adjustments aim to alleviate pressures on housing and social services. However, industry groups have expressed concerns that reducing immigration could negatively impact the labor pool and economic growth, particularly in sectors reliant on skilled immigrants

Widespread adoption of automation and artificial intelligence may reduce reliance on low-skilled labor.

Demand for workers in tech-driven industries is likely to increase, potentially reshaping workforce dynamics.

Global Risks: Geopolitical tensions, supply chain issues, or another global shock could reverse job recovery gains.

Wage Stagnation: Persistently high inflation, without corresponding wage growth, may deter labor force participation and suppress consumer spending.

The graph provides an insightful overview of labour shortages in Canada from 2014 to 2024, represented by blue bars (labour shortages) and the yellow line (intensity of labour shortages). These trends highlight evolving workforce challenges, including demand-supply imbalances and structural shifts in the labor market. Below is an in-depth analysis:

Source Stats Canada

Key Factors:

Key Factors:

Key Factors:

Key Factors:

Key Factors:

Labour Market Challenges Persist

Immigration as a Solution

Adapting to Intensity

Potential Risks

Canada’s labor market from 2020 to 2025 reflects resilience in the face of unprecedented challenges. While unemployment rates have returned closer to pre-pandemic levels, labor shortages, automation, and immigration reforms will continue to shape workforce dynamics. To secure a stable economic future, businesses and policymakers must embrace innovation, upskilling, and strategic hiring practices to address these evolving trends.